It must be one of the most commonly asked questions and with changes in employers NI and corporation tax it has left many directors wondering how to pay themselves in the most tax-efficient way.

Over the last few months, we’ve had many clients contact us to check that their current way of paying themselves is still the most tax-efficient.

Dividends or PAYE? A combination of both? What combination works best?

Unfortunately, there's no one answer, and thanks to the corporation tax changes for profits between £50K - £250K it has become increasingly difficult to predict.

The vast majority of company directors pay themselves the minimum £12,570 tax threshold on PAYE and take the £1k tax-free dividend - which is the most tax-efficient starting place for most situations.

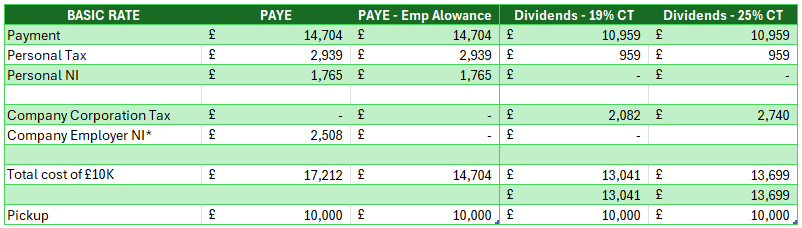

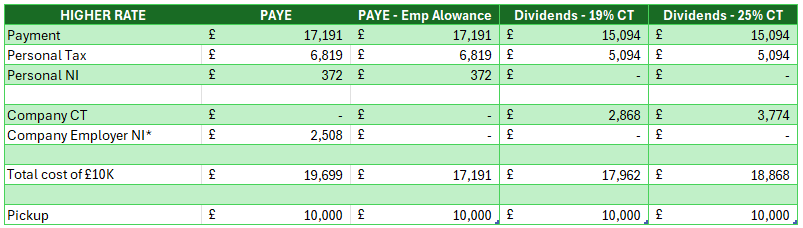

With this in mind, I’ve put together the below tables that show how much it will cost to take home an additional £10K depending on your situation.

The first table is for our basic rate taxpayers. This means your total earnings are between £12,570 & £50,000. I have shown the difference on PAYE if you are eligible for employment allowance (EA) and do not use the total £5K allowance on other employees in the business. To be eligible for EA there must be one staff member on the payroll being paid above the tax threshold of £9,100, or two directors with one being paid above the threshold.

*This would have to be paid equally over the year, otherwise the costs would be significantly higher

The second table is for our higher rate taxpayers. This means your total earnings are between £50,000 & £100,000.

In almost all scenarios it is best to utilise your £12,570 through PAYE and pay any additional earnings as dividends.

Remember you can only pay dividends if there's enough profit in the business.

For other scenarios or anything in between, do get in contact to run through your personal situation at [email protected]

For more information on EA: https://www.gov.uk/claim-employment-allowance/eligibility

Information correct as at 29th Feb 2024